The NPS function believes that human resources are vital to all its short, medium and long term achievements. Hence, the proper coordination of the following functional units is fundamental to the achievement of the payment system goals.

- Operations and Support (RTGS, CSD and Clearing House Systems)

- Oversight and Risk Management

- Policy and Research

OPERATIONS UNIT

Overview of the Operations Unit

The Unit’s main responsibility among other things is the administration of the Large Value Payment Systems (LVPSs) in Zimbabwe made up of the Zimbabwe Electronic Transfer and Settlement System (ZETSS), the real time gross settlement (RTGS) system for Zimbabwe and the Central Securities Depository (CSD) system for government securities. The Unit also oversees Clearing House activities.

In addition, the Unit manages ZETSS and CSD Customer Support Center, which ensures that payment systems related queries are logged and resolved timeously.

The CSD is interfaced with the RTGS to facilitate Delivery versus Payment (DvP) and better management of collateral.

ZETSS

The system was launched in 2002 and it is the main settlement hub for all transactions in the country.

Architecture

Benefits of ZETSS

- Provides a settlement system for the country

- Risk reduction in the payment system

- Improved liquidity management

- Improved efficiency in the payment system

- Provision of timely and accurate data

Central Securities Depository

The Central Securities Depository (CSD) for government securities was launched in 2006. It manages government stocks, bonds and bills such as Treasury Bills (TBs), Open Market Operations (OMO) bills and any other instruments which the government may find necessary to issue.

Architecture

Benefits of the CSD system

- Improved operational efficiency where the application of Delivery vs Payment (DvP) helps to manage risk.

- Risk reduction in the securities system as paper based securities are immobilized and dematerialized.

- Improved collateral management.

- Effective monitoring of securities

Cheque Clearing House

The Central Bank is responsible for managing the country’s cheque clearing house system which is conducted daily during working weekdays in the two major cities of Harare and Bulawayo.

ZETSS, CSD and Cheque Operating Rules

ZETSS and CSD operations are governed by agreed standards as specified in the ZETSS, CSD and Cheque Operating Rules.

In addition, participants are required to have appropriate technical capacity, including adequate contingency arrangements to avoid impacting on the smooth operation of the systems.

RTGS and CSD Operating Times

OVERSIGHT AND RISK MANAGEMENT FUNCTION

Oversight Overview

Oversight of payment, clearing and securities settlement systems is a Central Bank function whereby the objectives of safety and efficiency are promoted by monitoring, existing and planned systems, assessing them against these objectives, applicable standards and principles, and where necessary, inducing change (BIS).

It also ensures that infrastructural components and payment markets work smoothly, efficiently and fairly for all providers, participants and users.

The oversight role comprises both off site analysis and onsite inspections and processes which involve on-going monitoring of compliance of recognized systems.

In carrying out the oversight activities the Reserve Bank of Zimbabwe applies both the risk based approach which focuses on risks associated with payments systems and standard based by bench marking with international best practices.

Notwithstanding the above, the need to ensure that payment systems continuously pursue the level of technological and institutional developments is necessary to cater for the payment needs of a growing and open economy.

Oversight Scope

The main focus of the oversight role is on Systemically Important Payment Systems (SIPS) and System Wide Important Payment Systems (SWIPS).

SIPS refer to payment and clearing systems that constitute high value, low volume, time critical transactions such as the Real Time Gross Settlement (RTGS) and the Securities Settlement Systems (SSS).

SWIPS on the other hand are retail payment systems which are widely used in the country handling high volume and low value transactions. SWIPS include; cheque, card (ATMs and POS) mobile, internet payment streams as well as other emerging electronic means of payment.

To this end, the scope of central bank oversight therefore covers among other areas;

- payment clearing and securities, settlement systems providers, financial institutions and participants,

- payment instruments (including paper based and electronic),

- third-party service providers such as agents, merchants and critical services providers.

Oversight Framework

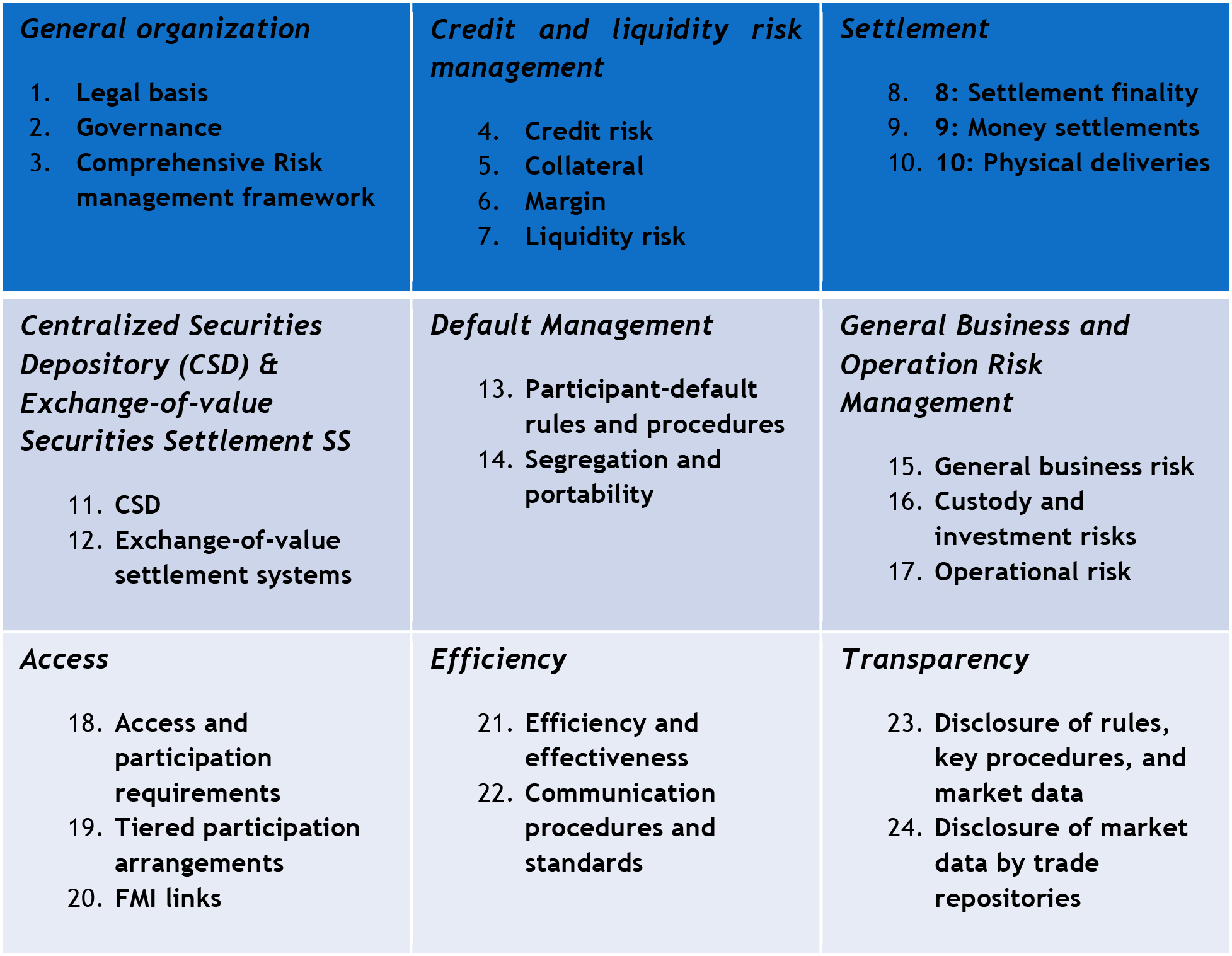

Payment, clearing and Securities Settlement systems are assessed in line with the minimum requirements.

POLICY AND RESEARCH

Overview of the Policy and Research Unit

The aim of the unit is to support payment system policy formulation by providing well-considered research and recommendations in line with regional and international developments.

The Research Unit contributes towards the development of appropriate payment systems standards and operating procedures in a technologically dynamic environment.